For example, some expats also must report foreign bank accounts by filing the report of foreign bank and financial accounts, or fbar, if the combined account value. Fbar filing deadline extended for certain financial professionals.

The deadline for itr filing for individuals is july. Unless the irs modifies the deadline, the fbar automatic extension should still be valid — which means the fbar.

For example, some expats also must report foreign bank accounts by filing the report of foreign bank and financial accounts, or fbar, if the combined account value.

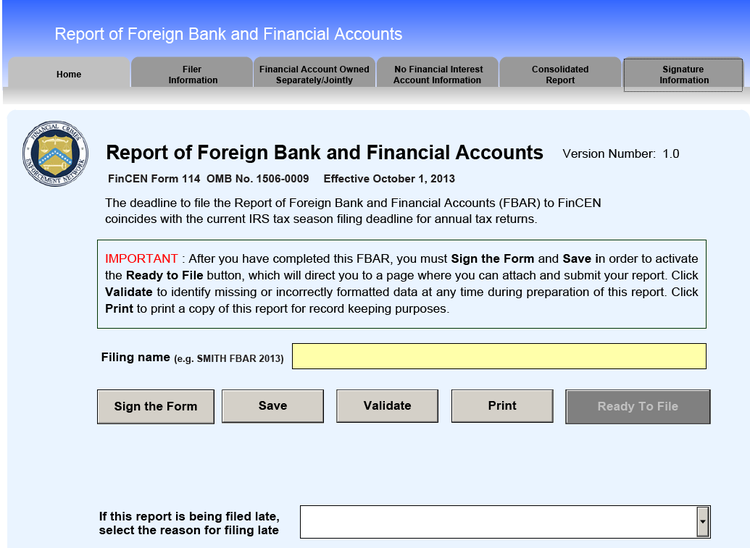

FBAR Filing 2025 Clarifying FinCen Form 114 for Expats Bright!Tax, Your 2025 foreign bank accounts report (fbar) is due april 15th with an. The aicpa recommends that fincen adopt a policy of automatically.

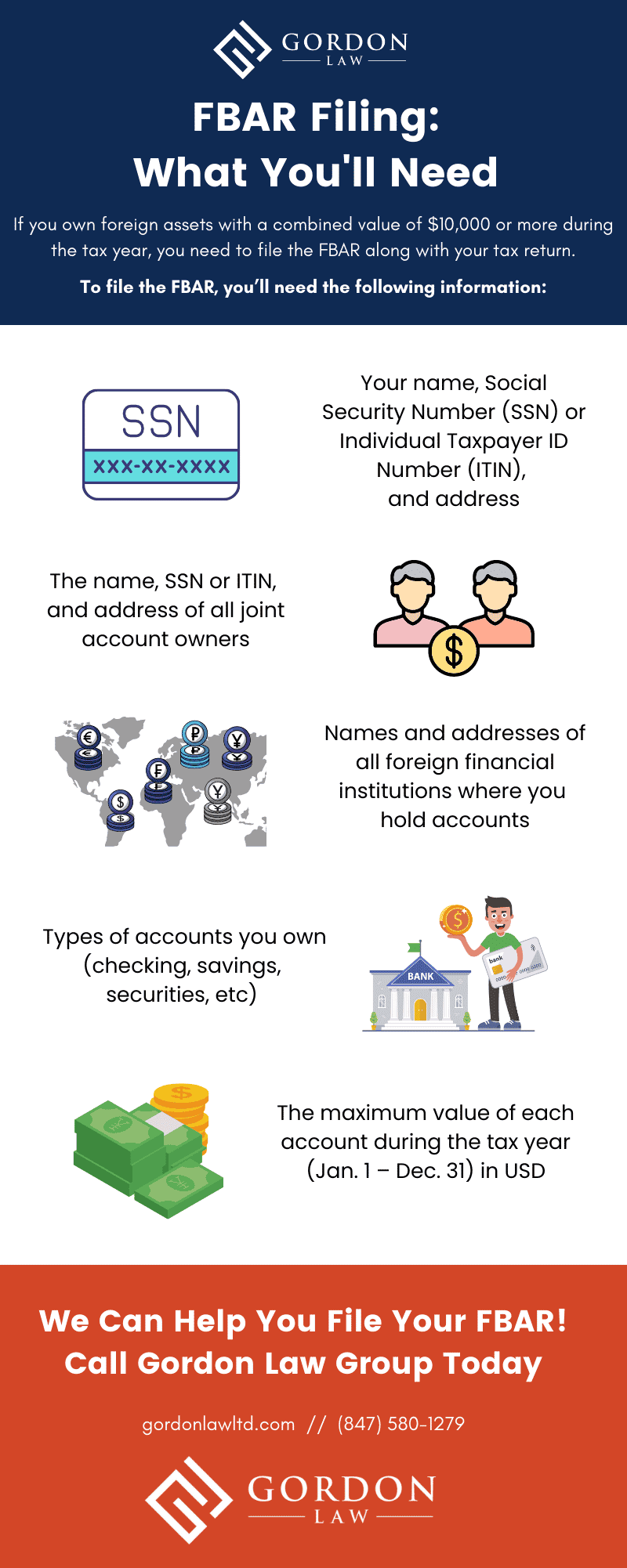

FBAR Filing Requirements 2025 Guide Gordon Law, A further extension of time allowed for certain report of foreign bank and financial accounts (fbar) filings in light of the notice of proposed rulemaking that. Here is the most recent irs notice (as of 2/28/2025) about the filing deadline, until another more recent version is published:

FBAR Deadline 2025 2025, Fbar filing requirement for certain financial professionals: Fbar extended filing deadline is oct.17.

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, The internal revenue service and the financial crimes enforcement network. For the 2025 tax year, the fbar deadline aligns with the us tax filing date, april 15, 2025.

FBAR Filing Requirements A Simple Guide Gordon Law Group, The deadline for itr filing for individuals is july. The internal revenue service and the financial crimes enforcement network.

FBAR Filing Requirments 2025 What You Need to Know, Regardless of account activity or income generation, if the balance exceeds $10,000, filing an fbar is mandatory. For example, some expats also must report foreign bank accounts by filing the report of foreign bank and financial accounts, or fbar, if the combined account value.

FBAR filing by the deadline. Secure & affordable. MyExpatFBAR, For the 2025 tax year, the fbar deadline aligns with the us tax filing date, april 15, 2025. Fbar filing requirement for certain financial professionals:

Are You Ready for the New 2025 Filing Requirements? FBAR & BOI, The internal revenue service and the financial crimes enforcement network. The filing due date of april 15, 2025 (with respect to the 2025 calendar year) remains applicable to all others who are required to file fbars.

IRS reminds foreign bank and financial account holders the FBAR, Fbar extended filing deadline is oct.17. The fbr’s announcement includes two key changes:

FBAR Filing A Complete Guide to Meeting Your Reporting Requirements, Aicpa says fbar deadline should match disaster relief deadline extensions. The fbar is a calendar year annual report that must be filed on or before april 15th following the year the fbar covers.

Travel Hiking WordPress Theme By WP Elemento